If you receive notice that a company whose shares you own is doing a stock split, rest assured that the value of your shares won't change. Investing in the stock market has risks, but a stock split isn't generally one to lose sleep over. If you invest through a brokerage, you should automatically receive credit for extra shares after a stock split. As a bonus, you may see share prices rise after a stock split, as more investors become interested in the company's shares. That would increase your net worth and bring you a little closer to retirement readiness. So why would a company consolidate its shares with a reverse stock split?

By raising share prices, a reverse stock split may help a company meet the requirements for trading on a major exchange. If share prices dip too low, a company could be booted from an exchange and lose access to investors. A reverse stock split elevates share prices, helping a company stay listed.

On the first full trading day of GE's reverse split, shares got an approximately 8-fold pop in value. Shareholders that would hold a fractional share as a result of the reverse stock split will receive a cash payment in lieu of such fractional shares. Heck, including dividends, Visa's stock has returned 861% over the past 10 years. That beats the S&P 500's total return by nearly 490 percentage points. The US airline has rewarded investors with lavish annualized returns of 26% and several stock splits since 1972. An investment of $1,000 in the company that year would be worth just over $2.2 million (£1.5m) in 2016, not including any reinvested dividends.

It's not hard to figure out why M&T Bank stock is one of Warren Buffet's favorites. Back in 1983, 1,300 shares were priced at $1,000 (£2,400/£1.6k in today's money). Thanks to several stock splits, those 1,300 shares would have turned in 26,000 worth $3.1 million (£2.1m), even without the dividends reinvested. Several biotech companies have experienced rapid growth in the 21st century, offering investors enviable returns. Back in 2000, $1,000 would buy you in 62.5 shares in Illumina, 'the Google of genetic testing', at its IPO. Today, those 62.5 shares have multiplied to 125 worth $17,935 (£12.3k), even without dividends reinvested.

Like Microsoft, information technology firm Oracle went public in 1986 and has offered investors similar bumper returns over the years. In 1987, $1,000 would have bought 50 shares, which would have turned into 16,200 shares worth $646,542 (£442k) by 2016, even without the dividends reinvested. Notable for its many stock splits, McDonald's went public in 1965 and hasn't looked back. Back then $1,000 would have got you 44.44 shares at the IPO, which would have grown to 33,046 shares worth $4.1 million (£2.8m) by 2016, even more if you'd reinvested the dividends. Taking into account a 2-1 split in 2012, 1,449 shares bought in 1995 for just under $1,000 would now be 2,898 shares worth $435,018 (£297k). Packaging maker Bemis isn't the most glamorous of companies but its stock market performance definitely has the wow factor.

A thousand dollars invested in 1982 would have bought 1,299 shares in the company, which would have turned into 41,568 shares worth $2 million (£1.4m) by 2016. Currently America's largest provider of supplemental insurance, Aflac was the company to invest in back in 1955. Investing $1,000 would have bagged you 92 shares that year which, after stock splits and dividend bonuses, would represent a holding worth $10.9 million (£7.5m) today. Johnson & Johnson's initial public offering was way back in 1944.

Back then, a single share would have set you back $37.50, so $1,000 would have snapped up 26.67 shares. You'd have been wise to splash the cash as today your holding would comprise 66,675 shares worth $7.5 million (£5.1m) or in the tens of millions if you'd reinvested the dividends. Key to wartime logistics, Dow has experienced steady growth since the 1940s. A single share in 1940 was priced at $70, so $1,000 invested in 1940 would buy you 14.28 shares, which by 2016 have multiplied to 4,623 shares worth $243,124 (£166k). And if you'd reinvested the dividends, your holding would be in the hundreds of thousands of dollars.

Click or scroll through the most lucrative long-term stocks from the year you were born, based on an initial investment of $1,000. They arefundsthat contain stocks from different companies, but they aretradedlike single stocks on a stock market exchange. They normally try to match the returns of a market index, like the Dow Jones Industrial Average or the S&P 500, by investing in the stocks that are included in that index. In other words, an ETF's performance will normally match the performance of the stock market.

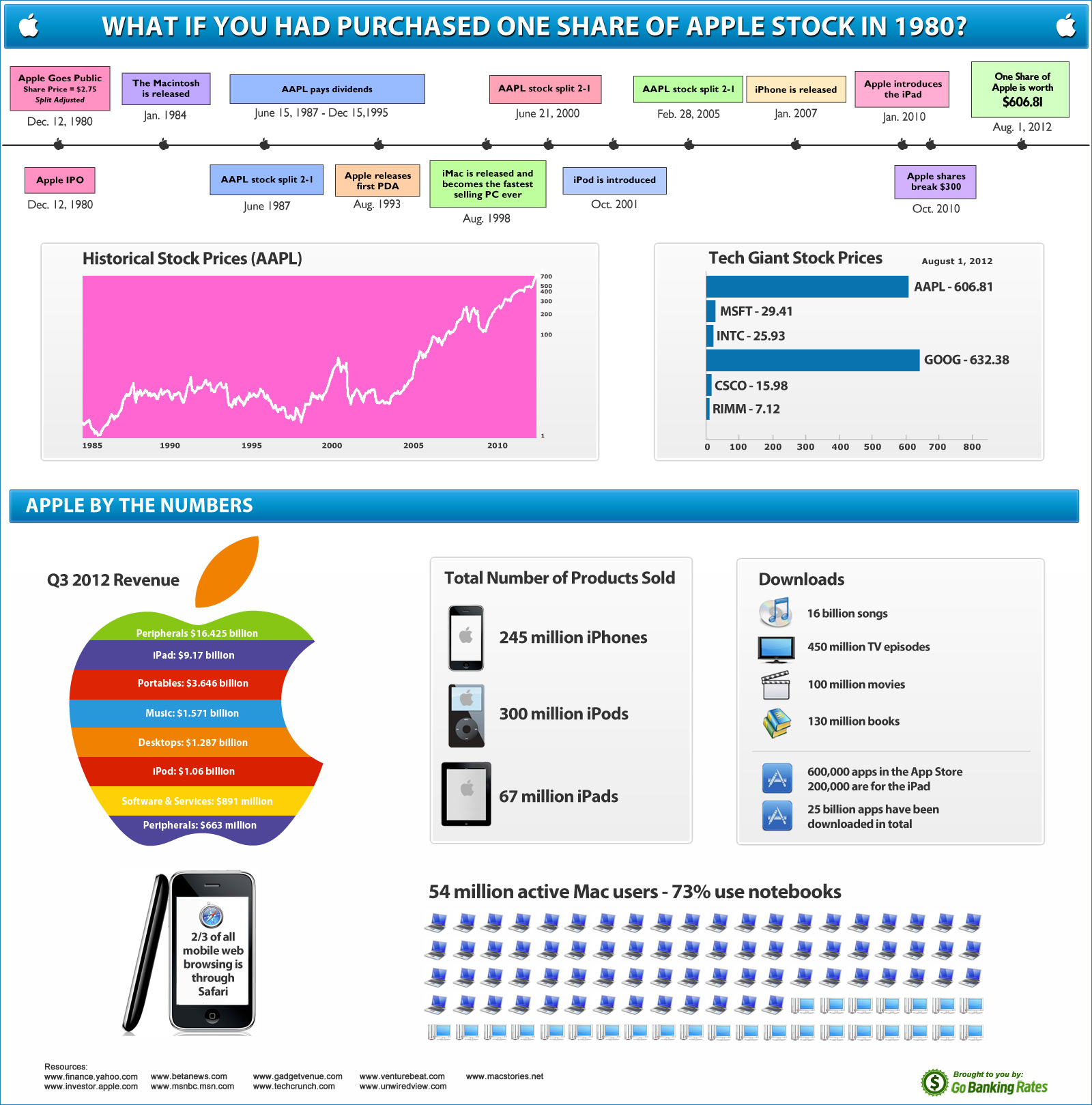

Learn which companies have produced impressive growth rates during the past decade. When Apple had its initial public offering of 4.6 million shares in December 1980, AAPL was valued at $22 per share. More than 40 out of 1,000 Apple employees become instant millionaires. As Apple's biggest shareholder, 25-year-old Steve Jobs ended the day with a net worth of $217 million. Known at the time as Flowers Industries, the American baked goods firm made its IPO in 1968.

An investment of 80 shares priced at $1,000 would be worth $140,000 (£96k) today, even more if you'd reinvested the dividends. An investor who purchased $1,000-worth of stock in Malaysia's Public Bank Berhad when it was listed in 1967 would now own 135,400 shares worth $336,000 (£230k), without dividends. A phenomenal investment, Walt Disney stock has enjoyed a compound annualized growth rate of 18% since 1948, as well as multiple stock splits and dividend payouts.

So $1,000 invested that year would be worth around $96 million (£66m) in 2016 assuming all the dividends had been reinvested. Tech stocks have been dominating the stock market for years now, and Netflix was the top-performer of the S&P 500 during the 2010s. Because many of the largest and highest-flying stocks are in the technology sector, that's helped to spur broader gains across the market. By comparison, a $500 investment in an ETF that tracks the S&P 500 would be worth about $910 today, assuming dividends were also reinvested. If you had spent $1,000 on Apple stock in 1980, you would have been able to buy about 45 shares at $22 apiece.

Apple shares have split four times since then—when a stock splits, it increases the number of shares an individual has—which puts the adjusted initial offering price at closer to 39 cents a share. Using that figure, an investment of $1,000 in Apple back in 1980 would yield close to $272,000 today. Past performance is not an indication of future results and investment returns and share prices will fluctuate on a daily basis.

Your investment may be worth more or less than your original cost when you redeem your shares. Current performance may be lower or higher than the performance data quoted. A stock split lowers the price of shares without diluting the ownership interests of shareholders. A shareholder would go from owning, say, 200 shares of $50 s to owning 400 shares of $25 shares.

If you've done the math, you'll have figured out that the total value of the shareholder's stock is the same. The shareholder isn't losing money and isn't losing market share relative to other shareholders. If the stocks pay dividends, the dividends per share will decrease by the same proportion as the price, but the total dividends earned will be unaffected. That's why, from a shareholder's perspective, a stock split is nothing to sweat. Accounting for stock splits (there have been three in Apple's history), a lone share of Apple stock purchased in 1980 would today be worth $4,502.

If one purchased $1,000 worth of Apple shares 33 years ago, that investment today would be worth $204,000. If one purchased $1,000 worth of Apple shares in June of 1997, when shares were trading as low as $3.56 a share, that investment would today be worth $632,000. British property investment firm Helical Bar has rewarded early investors with excellent returns. So $1,000 invested in 1985 would have grown to $723,000 (£494,492) by 2016.

Across the pond, you would have wanted to buy shares in a firm called Balchem, the best performer on the US stock market over the last 30 years. Its stock price has increased by 107,099% since the end of 1985. Cable TV exploded in the 70s and 80s, so it's no wonder shares in Comcast, the world's largest cable company, surged throughout this time.

And 471 shares bought for just over $1,000 in 1974 would have transformed into 72,707 shares worth $4.5 million (£3.4m) by 2016 if you'd reinvested the dividends. A classic long-term investment, Coca-Cola is renowned for offering patient investors decent returns. For instance, a $1,000 investment made in 1962 would be worth $221,445 (£152k) in 2016; even more you'd reinvested the dividends. At the time, Xerox was allowed to buy 100,000 shares of Apple at $10 a share. Considering stock splits, Xerox's initial investment of $1 million would be worth roughly $1.2 billion dollars today.

For what it's worth, the legendary investor Warren Buffett is still betting on Apple—despite his general reluctance to invest in technology companies. Buffett said back in May that his holding company, Berkshire Hathaway, has 9.8 million shares of Apple. If that's still the case, several market watchers have pointed out, the recent uptick in Apple's value means Berkshire Hathaway likely made more than $60 million off the investment in a single day last week. While the term "reverse ten-bagger" isn't in common use, it could apply to Chesapeake Energy Corporation. Shares are worth about a tenth of what they were 10 years ago, as your $1,000 would be, had you invested here. Between the financial crisis and then the massive drop in oil prices in late 2014, it really hasn't been a good decade for investors in Oklahoma City-based oil and gas producer Chesapeake Energy Corporation.

Dividend yields provide an idea of the cash dividend expected from an investment in a stock. Dividend Yields can change daily as they are based on the prior day's closing stock price. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default.

If a company decides for a 2-for-1 stock split, for instance, each shareholder who owned a stake prior to the split will now own twice as many shares. However, each shareholder's percentage stake in the company remains the same. While each shareholder now owns twice as many shares in the company, the company also now has twice as many shares available. The total dollar value of investors' shares also remains the same.

Because each stock was split in two, each stock's share price was also roughly divided in half. A pioneer of 3G and next-generation mobile technologies, Qualcomm made its IPO in 1991 and business has been booming ever since. If you'd held onto them, your holding would now consist of 2,254 shares worth $125,300 (£85.6k), even more if you'd reinvested the dividends. Apple shares have notched up breathtaking gains over the years. In 1976, early shareholder Ron Wayne sold stock that would be worth $35 billion (£24bn) today for a paltry $800 ($3,400/£2.3k in today's money).

And if you'd invested $1,000 at the firm's IPO in 1980, your holding would be worth $300,000 (£205k) today without the dividends reinvested. The Florida-based supermarket chain was definitely worthy of your investment cash back in 1959. Given the multitude of stock splits over the years and the company's impressive growth, a $1,000 investment made in 1959 would be worth around $4 million (£2.7m) in 2016. Big pharma firm Pfizer released 240,000 shares of common stock in 1942 – the cash generated helped fund the commercialization of penicillin.

One share cost $23.47 so if you bought $1,000-worth in 1942 it would equal 6,135 shares today worth $206,950 (£142k); more if you'd reinvested the dividends. Holding onto stocks for the long run can be highly lucrative even if you spread your risk. So $1,000 put into the S&P 500 in 1942 would offer an average annualized return of 8.9% – giving you a holding of $2.9 million (£2m) today if you'd reinvested the dividends. In fact, among the five members of the FAANG group, only Apple currently pays a dividend. It's still prudent to reinvest dividends, when possible, because it's an easy way to grow your portfolio's balance.

Many of the popular tech stocks have become synonymous with the definition of growth investing in recent years. With this strategy, investors knowingly pay a premium to buy the fastest-growing stocks because they expect these companies will continue to outpace the broader market. The trade-off, however, is that a lot of tech companies don't pay dividends. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products.

Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. On Thursday, Apple shares closed at a new all-time high of $300.35 (on a split-adjusted basis), adding $30 billion to the company's market capitalization of now $1.335 trillion. If you had bought $1,000 worth of Apple shares on January 9, 2007, the day Steve Jobs unveiled the original iPhone at MacWorld 2007, your investment would now be worth $26,103. Apple first sold shares to the public on Dec. 12, 1980, at $22 per share.

The stock has split four times -- three times at 2-for-1, and one split at 7-for-1. This means you would have received two shares for every one share, or seven shares in that one case. The waystock splitswork is that you receive more shares but the stock price is cut proportionally, so the value of your investment stays the same. For example, a $1 increase in a lower-priced stock can be negated by a $1 decrease in a much higher-priced stock, even though the lower-priced stock experienced a larger percentage change. In addition, a $1 move in the smallest component of the DJIA has the same effect as a $1 move in the largest component of the average.

The 1990s brought on rapid advances in technology along with the introduction of the dot-com era. The markets contended with the 1990 oil price shock compounded with the effects of the early 1990s recession and a brief European situation surrounding Black Wednesday. But if you're not careful, you could be betting your retirement future on the success of just a handful of companies . The last 10 years have been eventful ones for the stock market. As such, there is no shortage of stocks that have provided an excellent return on investment over the last decade.

Yet another fruitful internet-related investment opportunity, eBay went public in 1998 offering shares priced at $18 a pop. A $1,000 investment at the IPO for 55.55 shares would have grown to 7527 shares at $181,028 (£124k) by 2016, even more if you'd reinvested the dividends. Buying into the world-famous toy company would have been a shrewd plan back in 1989.

A holding of 64 shares priced at just under $1,000 would now be worth $31,481 (£21.5k) had you reinvested the dividends. A reliable investment, $1,000-worth of Proctor & Gamble shares acquired in 1981 would net you $35,000 (£24k) today if you'd reinvested the dividends – that's a return of 3,407%. Investing in the Indian stock market can pay off very nicely indeed. Buying $1,000-worth of shares in Wipro, one of India's top IT companies, back in 1980 would have increased to an eye-watering 9,600,000 shares worth $76.2 million (£52m) by 2016. Rather than just calculating the change in price, which would be about 101% in that time period, we've calculated the total return. That assumes you reinvested the dividends — a portion of a company's or fund operator's profit — you earned each quarter, which is an easy way to grow the value of your portfolio.

Let's say you want to invest in a company, but its stock price may be higher than what you want to pay. Instead of buying a whole share of stock, you can buy a fractional share, which is a "slice" of stock that represents a partial share, for as little as $5. For example, if a company's stock is selling at $1,000 a share and you were buying $200 worth of it, you would own 0.2 (20%) of a share.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.